Navigating the Tampa Bay Housing Market in 2025: What Luxury Buyers and Sellers Need to Know

The Tampa Bay housing market has been a standout performer over the past two decades, offering consistent appreciation and strong long-term gains. For luxury home buyers and sellers in Tampa, St. Petersburg, Clearwater, and Largo, understanding recent trends and historical performance can help inform strategic decisions. Below, we analyze the latest appreciation data, highlight key market insights, and offer actionable advice to succeed in today’s competitive Tampa Bay real estate landscape.

Long-Term Growth: Steady Appreciation Since 2004

One of the most compelling stories of the Tampa Bay area is the impressive growth in home values since 2004. According to Federal Housing Finance Agency (FHFA) data:

-

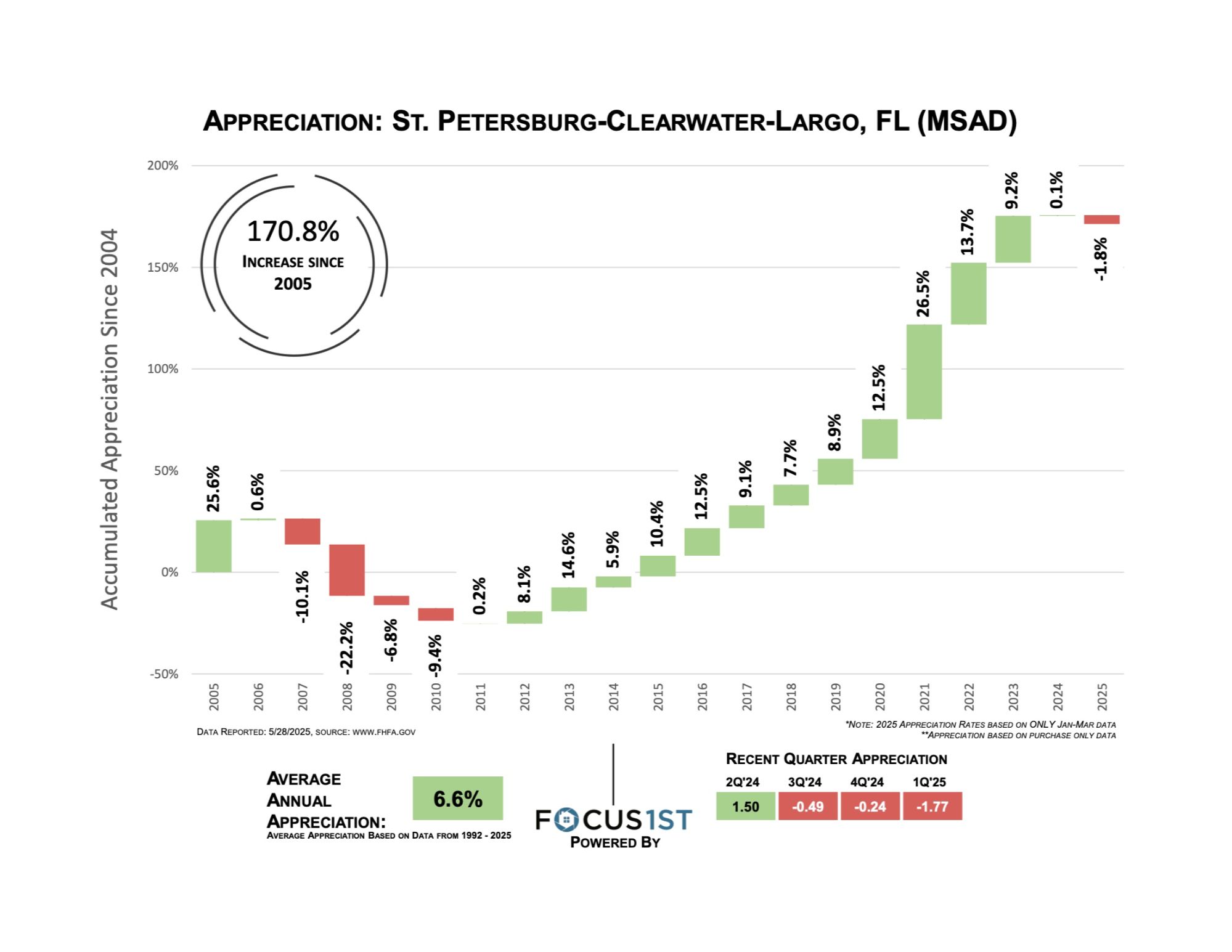

St. Petersburg–Clearwater–Largo has seen cumulative appreciation of 170.8% since 2004, equating to an average annual appreciation of 6.6% (data through 1Q 2025).

-

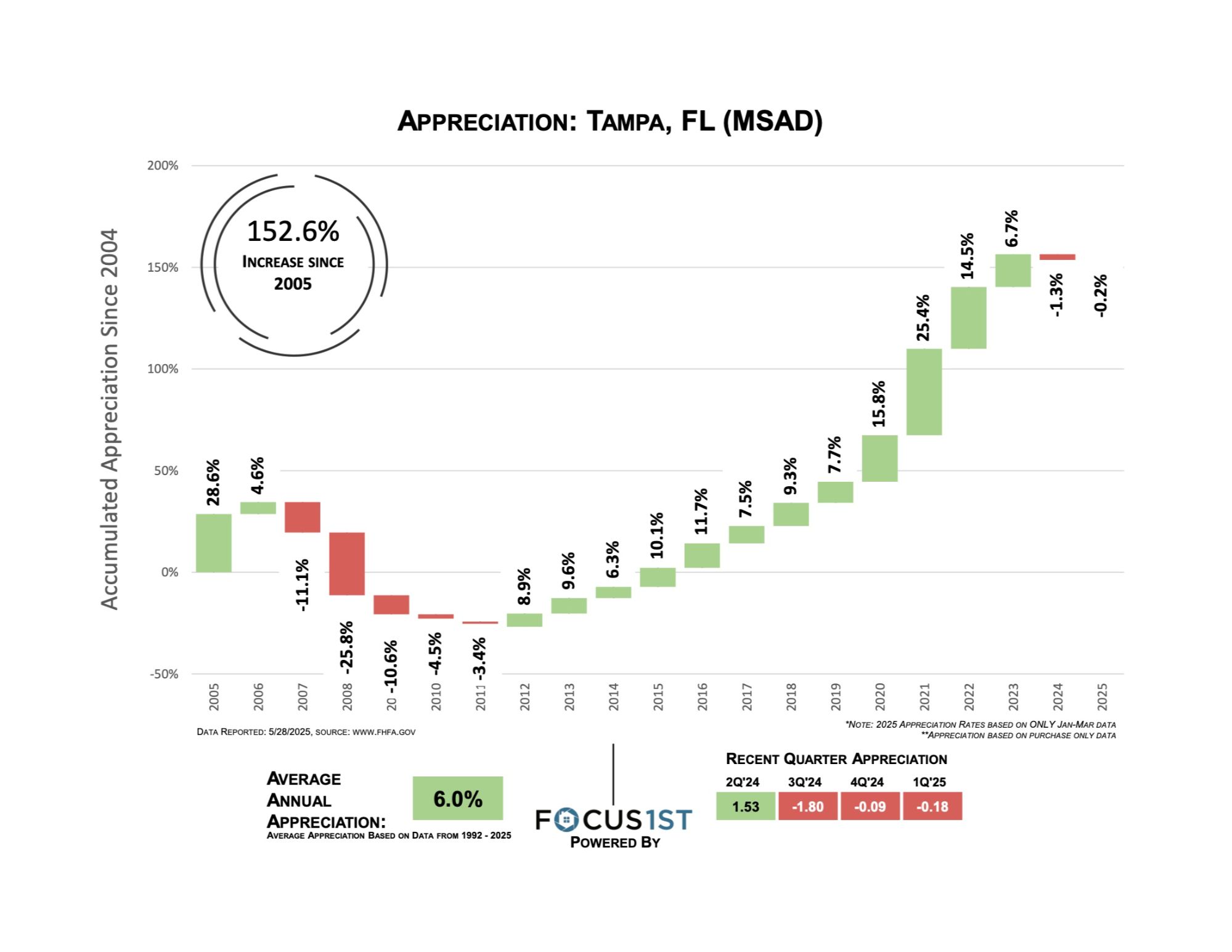

Tampa proper has enjoyed a cumulative increase of 152.6% over the same period, with an average annual appreciation of 6.0%.

These figures demonstrate that, even accounting for market downturns—such as the 2007–2011 correction—Tampa Bay real estate has rewarded long-term investors. Over roughly twenty years, a luxury home purchased at market lows would have appreciated substantially, underscoring the region’s resilience.

Recent Trends: Quarter-by-Quarter Dynamics

While long-term trends showcase robust growth, it’s equally important to examine quarterly fluctuations. Both Tampa and the St. Petersburg/Clearwater area experienced slight pullbacks in early 2025:

-

St. Petersburg–Clearwater–Largo (MSAD)

-

1Q 2025: –1.77% home-price appreciation

-

4Q 2024: –0.24%

-

3Q 2024: –0.49%

-

2Q 2024: +1.50%

-

-

Tampa (MSAD)

-

1Q 2025: –0.18% home-price appreciation

-

4Q 2024: –0.09%

-

3Q 2024: –1.80%

-

2Q 2024: +1.53%

-

Several takeaways emerge:

-

Seasonal and cyclical adjustment: The second quarter of 2024 saw positive bumps (1.50% in St. Pete; 1.53% in Tampa), likely tied to heightened spring demand. However, by late 2024 and early 2025, small declines indicate a brief cooling—potentially due to higher mortgage rates, inflationary pressures, and shifting buyer sentiment.

-

Relative resilience: Whereas some national markets have recorded double-digit quarterly declines, Tampa Bay’s pullback (sub-2%) remains modest. This suggests a stable luxury segment, where well-qualified buyers continue to transact at or near market values.

For luxury sellers, these minor dips can translate into negotiating leverage: motivated buyers may seek concessions, offering opportunities to highlight property upgrades, prime locations, and unique amenities to justify premium pricing. Meanwhile, luxury buyers should prepare for patience, knowing that slight seasonal softening could allow them to negotiate more favorable terms.

Why Tampa Bay Luxury Buyers Should Pay Attention

1. Inventory Shifts and Neighborhood Opportunities

-

Limited new construction in core luxury enclaves (e.g., Davis Islands, Hyde Park, South Tampa) often means resale homes dominate. Be ready to act quickly when a turnkey luxury property hits the market.

-

Emerging corridors: Areas like Westshore Marina District and downtown Tampa have seen a surge of high-end condominium developments. Buyers seeking a downtown-adjacent lifestyle should explore these upcoming neighborhoods.

2. Interest-Rate Sensitivity

While rates began to tick down in late 2024, early 2025 showed tightening in affordability. Luxury buyers should:

-

Lock favorable rates when possible; even a 0.25% reduction on a jumbo mortgage yields significant savings.

-

Explore adjustable-rate mortgages (ARMs) for a potential near-term cost advantage, especially if planning to refinance within 5–7 years.

3. Appreciation Projections

Given the 6.6% average annual appreciation in St. Pete/Clearwater/Largo and 6.0% in Tampa, luxury buyers can expect:

-

Long-term wealth preservation: Even if short-term fluctuations occur, historical data indicates robust appreciation over multi-year holding periods.

-

Neighborhood outperformance: Highly sought-after luxury enclaves often outperform broader metrics. For example, waterfront mansions in Davis Islands and Port Tampa have historically appreciated closer to 7–8% annually.

Key Strategies for Luxury Sellers

1. Price Strategically

Rather than simply deferring to comps from 6–12 months ago, consider:

-

Current market dynamics: With Q1 2025 showing slight declines, listing a home at or just below recent high comps can generate competitive offers.

-

Value-add enhancements: High-end buyers expect top-tier finishes. Investing in minor fast-ROI renovations (e.g., high-end appliances, smart home integrations, professional staging) can make your property stand out, supporting a premium price.

2. Highlight Lifestyle and Exclusivity

Luxury buyers often seek more than four walls; they covet:

-

Architectural details: Emphasize custom millwork, vaulted ceilings, and designer fixtures.

-

Location perks: Proximity to waterfront, yacht clubs, fine dining, and cultural attractions (e.g., Straz Center, Ruth Eckerd Hall) commands a premium.

-

Community amenities: Gated neighborhoods with private parks or country club access (e.g., Avila Golf & Country Club) should be showcased as added value.

3. Market Across Multiple Channels

-

Digital marketing: High-quality video tours, drone footage of bayfront estates, and targeted paid campaigns (e.g., geo-targeted ads to Northeast or Midwest high-income ZIP codes) help you reach out-of-state buyers.

-

Broker networking: Collaborate with top nationwide luxury brokerages (e.g., Engel & Völkers affiliates, Christie’s International) to tap into their database of ultra-high-net-worth clients.

Looking Ahead: 2025 and Beyond

Although 1Q 2025 showed slight declines (-0.18% in Tampa; -1.77% in St. Pete/Clearwater), experts forecast a moderate resurgence in late 2025 as interest rates stabilize and buyer confidence returns. For luxury buyers and sellers:

-

Sellers should consider listing in late summer or early fall, when historically demand ticks upward, and competition from newly constructed inventory wanes.

-

Buyers can explore off-market opportunities or pocket listings; slight market softening can also yield concessions such as closing-cost credits or price reductions on under-priced luxury homes.

Ultimately, Tampa Bay’s luxury real estate remains a compelling long-term investment, anchored by strong fundamentals: a growing local economy, high-quality waterfront lifestyle, and a steady influx of affluent retirees and relocating professionals. By leveraging the historical data (cumulative appreciation up to 170.8% in St. Pete/Clearwater and 152.6% in Tampa) and recognizing current quarter-by-quarter dynamics, both buyers and sellers can craft strategies that maximize value in 2025 and beyond.

Actionable Tips for Success

-

Engage a Local Luxury Expert

Work with an agent who understands nuanced micro-market trends—whether it’s the evolving condo market along Bayshore Boulevard or the waterfront estates in Tierra Verde. -

Conduct Seasonal Timing Analysis

Avoid listing during traditionally slow winter months (November–January). Instead, prepare to launch in spring (March–May) or early fall (September–October), aligning with peak buyer activity. -

Leverage Data-Driven Pricing

Utilize real-time FHFA metrics and local MLS analytics to price homes competitively. Remember that a 1–2% pricing adjustment can be the difference between a swift sale and extended days on market. -

Prepare for Financing Trends

If you’re a buyer: get pre-qualified for a jumbo loan to solidify your offer. If you’re a seller: be aware that some buyers may request temporary rate-buydown concessions to offset higher interest rates. -

Highlight Investment Potential

Use market history—such as the 6.6% and 6.0% annual appreciation rates—as proof points when marketing to out-of-state investors seeking second homes or rental income properties.

Conclusion

In the ever-evolving Tampa Bay housing market, luxury buyers and sellers who stay informed, leverage data correctly, and partner with seasoned professionals are best positioned to achieve their real estate goals. Despite minor short-term fluctuations in early 2025, the region’s long-term appreciation trends (up to 170.8% in St. Pete/Clearwater and 152.6% in Tampa) underscore a resilient market that continues to reward strategic investment. By combining historical insights, current quarter-by-quarter analysis, and luxury-focused tactics, you can navigate 2025 with confidence—whether you’re acquiring a dream waterfront estate or marketing a trophy property to high-net-worth buyers.

If you have questions about specific neighborhoods, want a personalized valuation, or are ready to explore luxury offerings in Tampa Bay real estate, contact me today. Let’s ensure your next move aligns with both current market realities and long-term wealth-building opportunities.

Categories

- All Blogs (105)

- 345 Bayshore (2)

- 400 Central (1)

- Apollo Beach (18)

- Arbor Greene (5)

- Avila (32)

- Ballast Point (3)

- Bayshore Beautiful (3)

- Beach Park (24)

- Bel Mar Gardens (2)

- Brandon (7)

- Carrollwood (26)

- Channel District (9)

- Cheval (18)

- Clearwater (21)

- Clearwater Beach (2)

- Cordoba Ranch (3)

- Cory Lake Isles (2)

- Culbreath Isles (18)

- Davis Islands (31)

- Downtown St Petersburg (7)

- Downtown Tampa (34)

- Golfview (17)

- Grand Central at Kennedy (1)

- Gulf Beaches (4)

- Harbour Island (35)

- Home Buying (5)

- Home Improvement (1)

- Home Selling (17)

- Hunters Green (13)

- Hyde Park (32)

- Indian Rocks Beach (4)

- Ladera (5)

- Lakewood Ranch (9)

- lutz (32)

- Madeira Beach (14)

- Marina Pointe (18)

- Market Health Update (20)

- New Suburb Beautiful (2)

- New Tampa (6)

- Odessa (23)

- ONE St. Petersburg (1)

- Palma Ceia (3)

- Parkland Estates (3)

- Pendry Tampa (4)

- Pinellas Condos (3)

- Plaza Harbour Island (4)

- Ritz-Carlton Tampa (8)

- Riverview (22)

- Saltaire (1)

- Seminole Heights (21)

- Skypoint (4)

- Snell Isle (9)

- South Tampa (57)

- St Pete Beach (15)

- St Petersburg (31)

- Sunset Park (22)

- Tampa (55)

- Tampa Bay Real Estate (32)

- Tampa Condos (6)

- Tampa Edition (5)

- Tampa Palms (18)

- The Nolen (1)

- The Place Channelside (1)

- Tierra Verde (13)

- Towers of Channelside (1)

- Venetian Isles (11)

- Viceroy Clearwater Beach (1)

- Virginia Park (10)

- Waldorf Astoria St Petersburg (1)

- Water Street (17)

- Waterleaf (2)

- Westchase (28)

- Westshore Marina District (21)

- Westshore Yacht Club (1)

- Ybor (7)

Recent Posts