Tampa Bay Real Estate Market Analysis: Home Value Appreciation Trends (1992-2024)

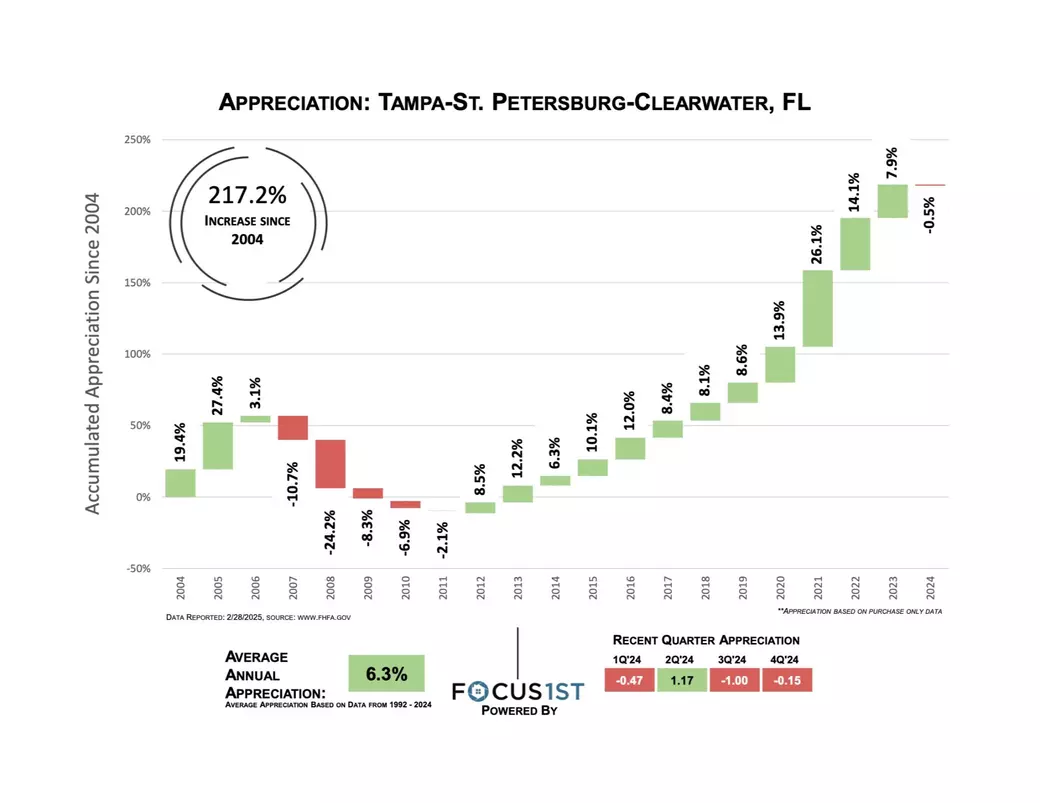

The Tampa Bay housing market has experienced substantial growth over the past few decades, with cumulative home price appreciation reaching an impressive 217.2% since 2004. Based on data from the Federal Housing Finance Agency (FHFA) as of February 2025, this analysis breaks down the historical trends, recent market shifts, and what this means for buyers, sellers, and investors in the Tampa-St. Petersburg-Clearwater region.

Long-Term Growth: A Strong Foundation

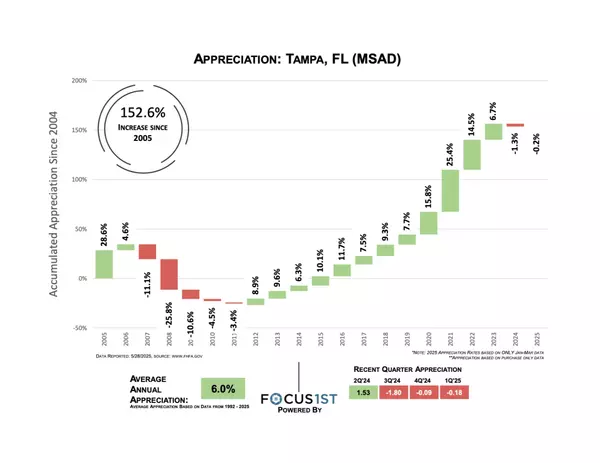

Tampa Bay has consistently been one of the most attractive housing markets in Florida, with an average annual appreciation rate of 6.3% from 1992 to 2024. While the market has experienced fluctuations, the long-term trajectory shows a strong upward trend, making Tampa Bay a reliable location for real estate investment.

Major Appreciation Periods:

- Early 2000s Boom (2004-2006): Tampa saw double-digit appreciation rates, peaking before the 2008 financial crisis.

- Market Correction (2007-2012): A sharp decline followed, with -24.2% depreciation in 2008 alone.

- Post-Recession Recovery (2013-2019): A steady recovery ensued, with appreciation rates stabilizing between 6% and 12% annually.

- Pandemic Surge (2020-2022): The market saw an explosion in demand, with appreciation rates reaching 26.1% in 2021, fueled by low interest rates and migration trends.

- Recent Market Stabilization (2023-2024): After a period of hypergrowth, appreciation rates have normalized, with fluctuations in the past four quarters.

Recent Market Trends (2024)

Quarterly data for 2024 suggests a market in transition:

- Q1 2024: -0.47% depreciation

- Q2 2024: 1.17% appreciation

- Q3 2024: -1.00% depreciation

- Q4 2024: -0.15% depreciation

This indicates that Tampa Bay's real estate market has cooled slightly, possibly due to higher interest rates, inflation concerns, and buyer affordability constraints. However, the long-term fundamentals remain strong.

What This Means for Buyers and Sellers

For Buyers:

- Market Timing Matters: With minor fluctuations in recent quarters, buyers may have negotiating power on certain listings.

- Long-Term Value: Even with short-term dips, historical trends suggest continued appreciation, making homeownership in Tampa Bay a solid investment.

- Interest Rate Sensitivity: Mortgage rates play a crucial role in affordability—monitoring potential rate cuts or increases will be key.

For Sellers:

- Strategic Pricing Is Essential: Overpricing in a stabilizing market can lead to extended days on the market.

- Location Still Commands Premiums: Prime neighborhoods, waterfront properties, and luxury homes in South Tampa and St. Petersburg continue to perform well.

- Inventory Levels Matter: Lower inventory levels could still favor sellers in certain price segments.

Final Thoughts

Despite some recent quarterly fluctuations, Tampa Bay’s real estate market remains strong, resilient, and poised for long-term growth. With an average annual appreciation rate of 6.3% and over 217% cumulative appreciation since 2004, the region continues to attract homebuyers, investors, and luxury clientele looking for value and stability.

If you’re considering buying or selling in the Tampa Bay area, understanding market trends and making informed decisions is crucial. For expert guidance, reach out to Shane Vanderson at Engel & Völkers South Tampa.

Categories

- All Blogs (226)

- 345 Bayshore (1)

- Apollo Beach (6)

- Avila (19)

- Beach Park (16)

- Carrollwood (10)

- Channel District (7)

- Cheval (8)

- Clearwater (19)

- Clearwater Beach (1)

- Culbreath Isles (16)

- Davis Islands (21)

- Downtown St Petersburg (4)

- Downtown Tampa (22)

- Global Guide (7)

- Golfview (15)

- Grand Central at Kennedy (1)

- Gulf Beaches (3)

- Harbour Island (25)

- Home Buying (5)

- Home Design (12)

- Home Improvement (1)

- Home Selling (11)

- Hunters Green (6)

- Hyde Park (21)

- Indian Rocks Beach (4)

- Lakewood Ranch (8)

- lutz (17)

- Luxury Homes (10)

- Madeira Beach (12)

- Marina Pointe (15)

- Market Health Update (20)

- Odessa (7)

- Pendry Tampa (3)

- Plaza Harbour Island (2)

- Private Residences (3)

- Ritz-Carlton Tampa (3)

- Riverview (7)

- Seminole Heights (7)

- Skypoint (4)

- Snell Isle (8)

- South Tampa (34)

- St Pete Beach (14)

- St Petersburg (28)

- Sunset Park (17)

- Tampa (35)

- Tampa Bay Real Estate (27)

- Tampa Edition (4)

- Tampa Palms (7)

- The Place Channelside (1)

- Tierra Verde (13)

- Towers of Channelside (1)

- Venetian Isles (11)

- Viceroy Clearwater Beach (1)

- Virginia Park (5)

- Water Street (14)

- Westchase (11)

- Westshore Marina District (18)

Recent Posts